I recall a specific audit I conducted for a mid-sized steel erection company that was technically compliant but financially suicidal. They had impeccable OSHA 300 logs and a low Experience Modification Rate (EMR), yet they were one lawsuit away from bankruptcy because their leadership believed Workers’ Compensation was an "iron dome" against all employee lawsuits. They were unaware that a simple contractual indemnification clause with a General Contractor could bypass their Workers' Comp immunity entirely, exposing them to millions in damages for a single fall from height.

This article is not just about insurance procurement; it is about the survival of your organization in a litigious environment. Employer Liability (EL) Insurance is the often-misunderstood "Part Two" of a standard Workers' Compensation policy, designed to cover the gap between statutory benefits and civil litigation. For HSE professionals, understanding EL is critical because when a claim triggers this policy, your risk assessments, training matrices, and maintenance logs stop being "compliance paperwork" and immediately become defense evidence in a negligence trial.

Defining the Shield: What is Employer Liability Insurance?

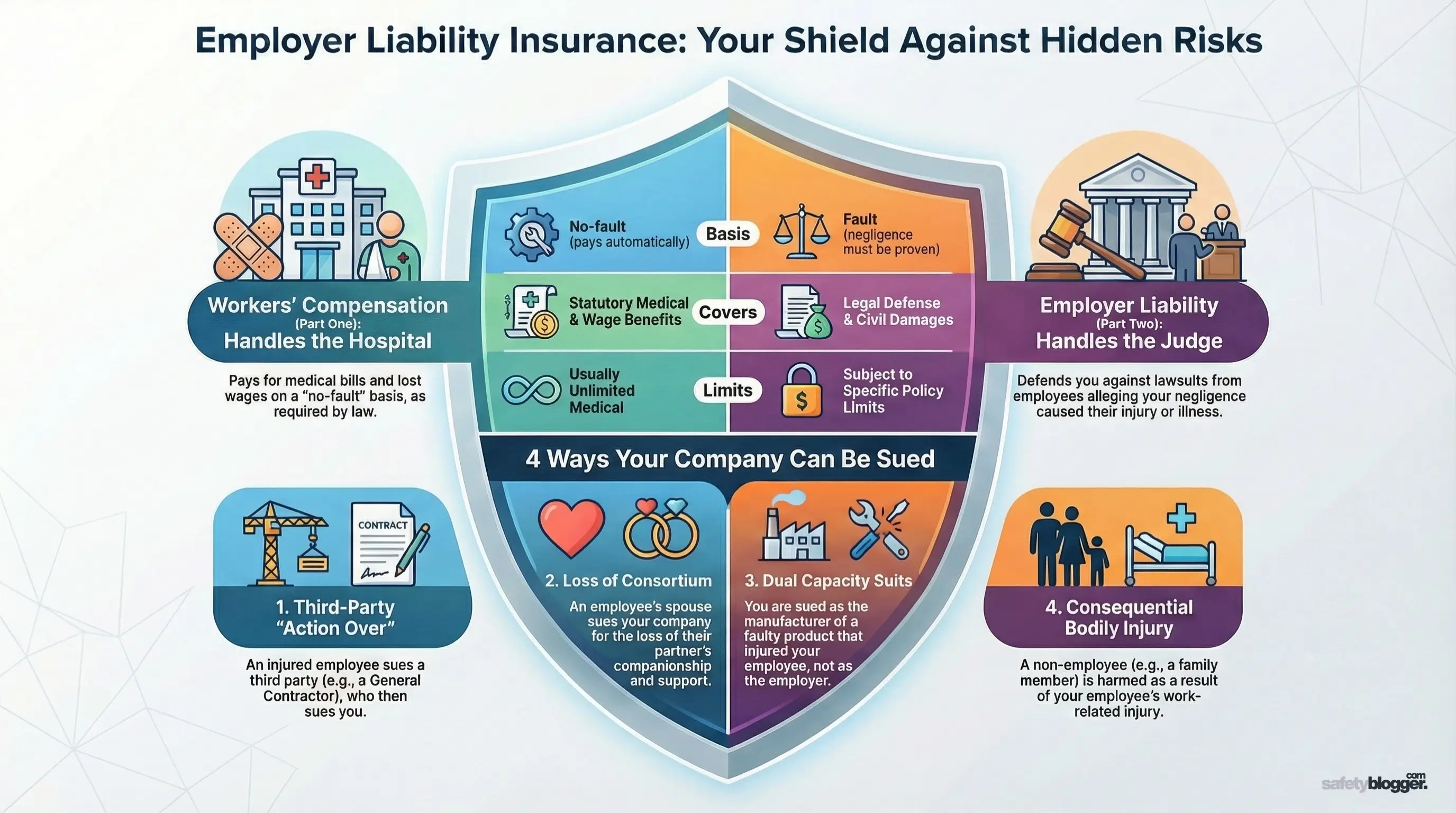

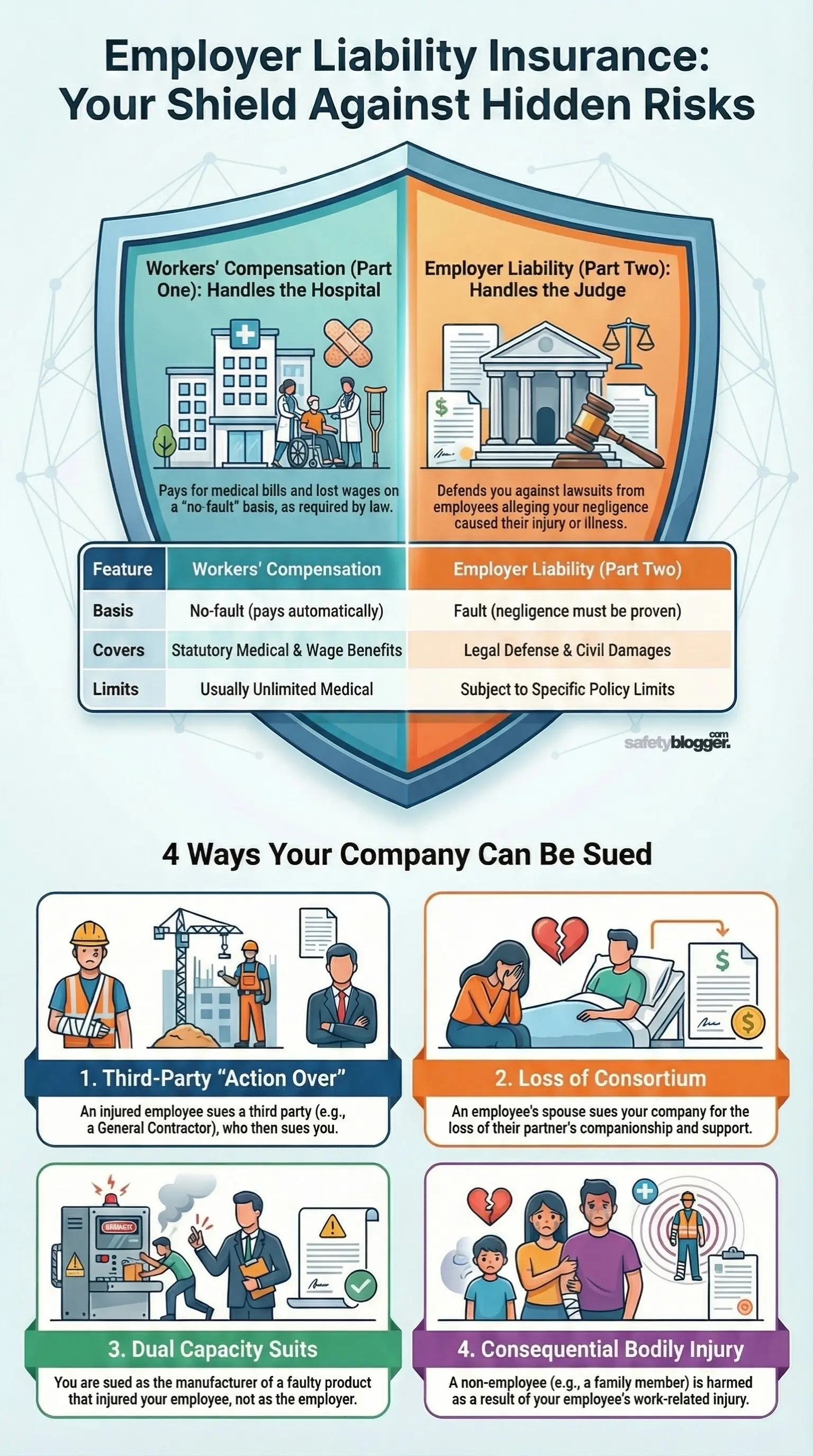

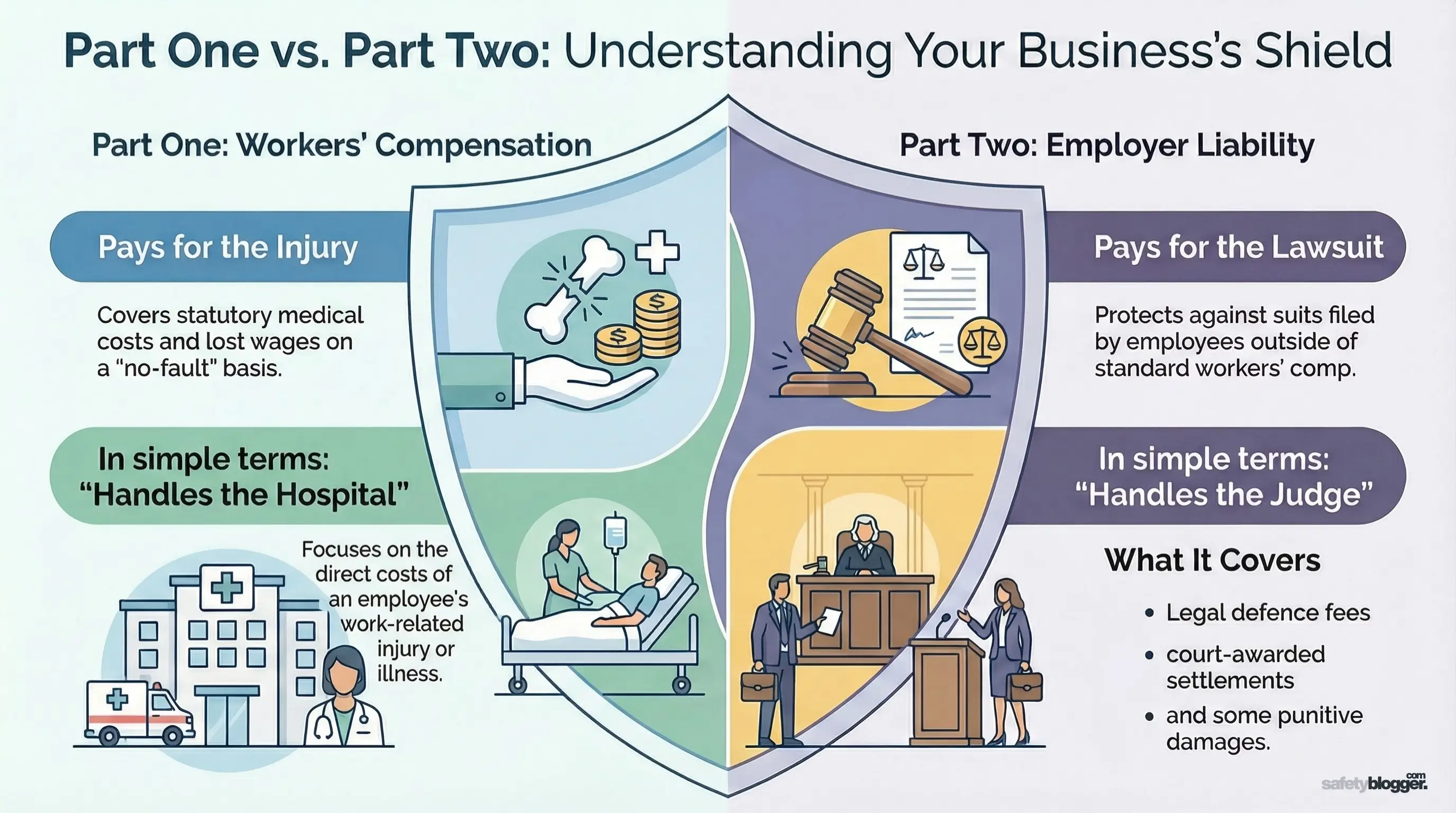

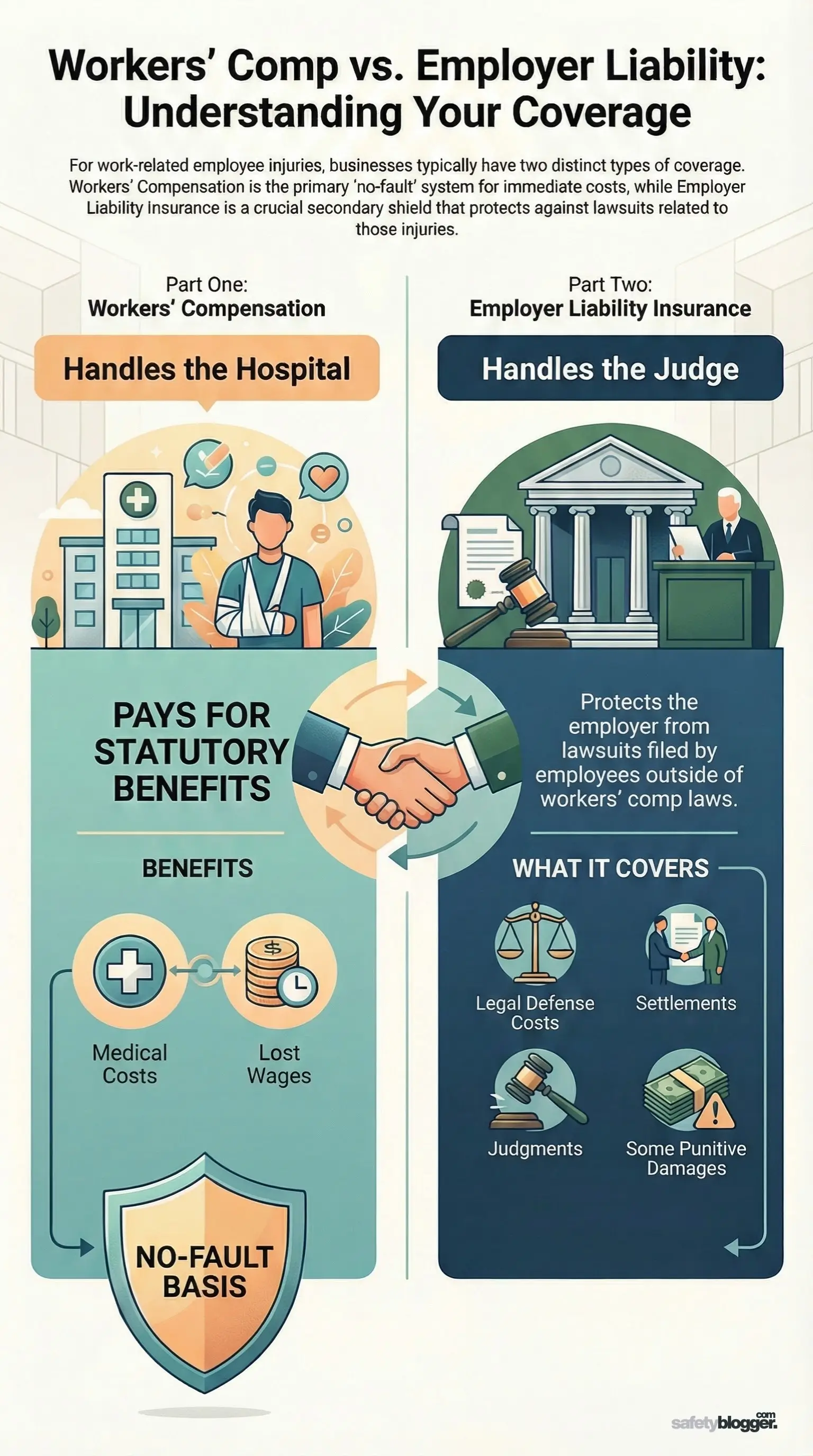

Before dissecting the legal failures, we must clearly define the instrument itself. In the binders of insurance documents I review during corporate audits, Workers' Compensation is invariably listed as "Part One." It pays the statutory bills—medical costs and lost wages—on a "no-fault" basis.

Employer Liability Insurance is "Part Two."

It is the coverage that protects the employer against lawsuits filed by employees (or their families) for work-related bodily injury or illness that falls outside the scope of state Workers' Compensation laws. While Part One pays for the injury, Part Two pays for the lawsuit.

If an employee bypasses the statutory system and sues you in civil court alleging negligence, Employer Liability insurance covers:

Legal Defense Costs: The attorney fees to defend the company, which often exceed the cost of the injury itself.

Settlements and Judgments: The damages awarded by a court if the employer is found negligent.

Punitive Damages (in some jurisdictions): Financial penalties intended to punish the employer for gross negligence.

In simple terms: Workers' Comp handles the hospital; Employer Liability handles the judge.

The "Grand Bargain" and Where It Fails

Most safety professionals operate under the assumption of the "Grand Bargain"—the historic trade-off where employees gave up their right to sue employers in exchange for guaranteed, no-fault medical and wage benefits. However, this shield is not impenetrable, and believing it is can be a fatal error for a company.

The reality is that while Workers' Compensation (Part One) covers statutory costs like medical bills and lost time, it does not cover "tort" liability. Courts have carved out specific exceptions where an employee can sue an employer for negligence. When they do, they aren't asking for a $20,000 medical payout; they are suing for pain and suffering, loss of enjoyment of life, and punitive damages—figures that often run into the millions.

Key differences between the two coverages:

Workers' Comp (Part One): Pays statutory benefits. No fault required. Unlimited medical coverage (usually).

Employer Liability (Part Two): Pays for legal defense and civil damages. Fault (negligence) must be proven. Subject to specific policy limits.

Pro Tip: Never assume your Workers' Compensation policy covers everything. I have seen companies face "gap claims" in monopolistic states like Ohio or North Dakota because they failed to purchase specific "Stop Gap" endorsements for Employer Liability.

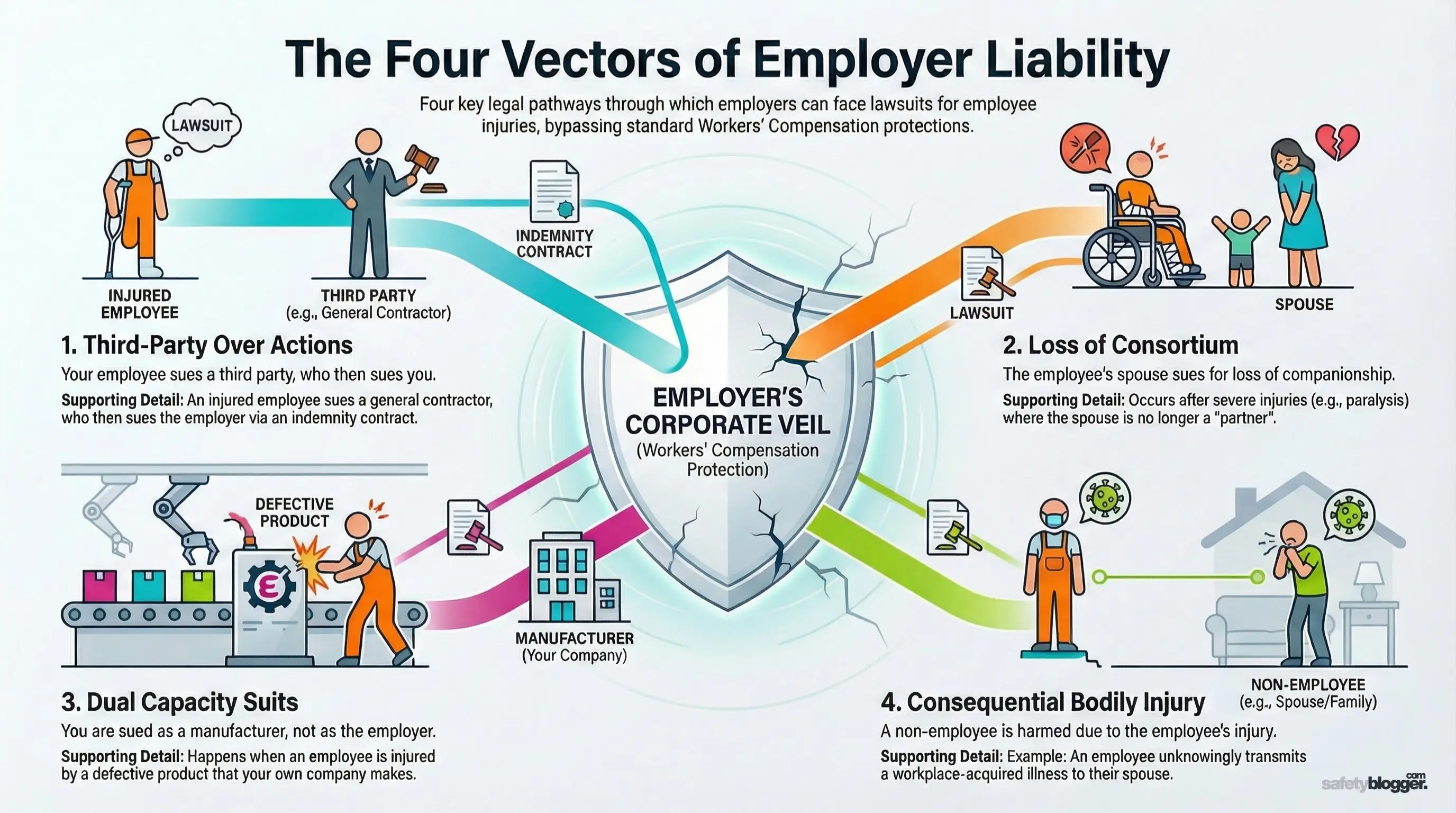

The Four Vectors of Liability

In my experience investigating serious incidents, rarely does an injured worker just accept the statutory check and go home if the injury is catastrophic. Plaintiff attorneys actively look for ways to pierce the corporate veil using four specific legal vectors.

1. Third-Party Over Actions (The "Action Over")

This is the single biggest threat in the construction and heavy industrial sectors. It occurs when an injured employee sues a third party (like a General Contractor or Building Owner) for an unsafe workplace. That third party, armed with an indemnification contract, then sues you (the employer) to recover their losses. Effectively, your own employee is suing you indirectly.

2. Loss of Consortium

These lawsuits are filed not by the employee, but by their spouse or family. They argue that the injury was so severe (e.g., Traumatic Brain Injury or paralysis) that the spouse has lost the companionship, services, and support of their partner. Since the spouse was never part of the Workers' Comp "bargain," they are free to sue for negligence.

3. Dual Capacity Suits

This arises when an employer wears two hats. For example, if you manufacture a chemical and your own employee is burned by it while working, they might sue you not as their employer (barred by WC), but as the manufacturer of a defective product (Product Liability).

4. Consequential Bodily Injury

I once advised on a case where a healthcare worker contracted a bloodborne pathogen due to a needle stick injury. She unknowingly transmitted it to her husband. The husband sued the hospital. Because he was not an employee, his illness was a consequential bodily injury covered under EL, not Workers' Comp.

The Role of HSE Documentation in Defense

When an Employer Liability claim hits, the burden of proof shifts. Unlike the "no-fault" Workers' Comp system, an EL claim requires the plaintiff to prove the employer was negligent. As the HSE authority, you become the primary witness for the defense.

Your documentation must prove that the company exercised "due diligence." If your risk assessments are generic or your training records are missing, the insurer may settle, but your premiums will skyrocket, and in some cases involving gross negligence, coverage could be denied.

The "Defense Triad" of documents:

Specific Risk Assessments: A generic "Job Hazard Analysis" isn't enough. You need proof that the specific hazard (e.g., the specific chemical or machine part) was identified and controlled.

Verified Training Records: Sign-in sheets are weak evidence. Competency verifications (quizzes, practical demos) prove the worker actually understood the training.

Enforcement Logs: You must prove you didn't just have rules, but that you enforced them. Disciplinary records for safety violations are your proof that you do not tolerate unsafe acts.

Policy Limits and The "Exclusion Trap"

One of the most dangerous trends I see in contract reviews is the mismatch between insurance limits and real-world risk. Standard Employer Liability policies often come with basic limits of $100,000 per accident / $500,000 policy limit / $100,000 per employee.

In today's litigation climate, $100,000 is burned through in the first month of legal discovery. If a judgment comes in at $2 million and you have $100,000 in coverage, the remaining $1.9 million comes directly from the company's operating capital.

Critical Policy Checks:

The Umbrella Connection: Ensure your EL policy is scheduled underneath your Commercial Umbrella (Excess) policy. This provides layers of millions of dollars in protection above the basic limit.

The "Action Over" Exclusion: In high-risk states like New York, some cheaper insurance carriers sneak in an exclusion for "Action Over" claims. If you are a subcontractor and you have this exclusion, you are effectively uninsured for your biggest liability risk.

Pro Tip: When reviewing subcontractor Certificates of Insurance (COI), do not just look at the dates. Specifically ask: "Does this policy contain an Action Over exclusion?" If it does, do not let them on site.

Global Perspectives on Employer Liability

While the terminology changes, the risk remains constant across borders. In my work across the UK and the Middle East, I have seen how different jurisdictions handle this exposure, and it requires a nuanced approach for multinational companies.

United Kingdom and Europe

In the UK, the Employers’ Liability (Compulsory Insurance) Act 1969 makes this coverage mandatory by law (minimum £5 million). Unlike the US, where WC is the primary remedy, the UK system allows injured workers to sue for negligence more easily if they can prove a breach of statutory duty. Here, compliance with regulations like PUWER and COSHH is your primary defense.

Canada and Australia

These jurisdictions generally have a much higher bar for suing employers, often requiring proof of "gross negligence" or "intentional acts" to bypass the provincial or state compensation schemes. However, when that bar is met (e.g., a supervisor ordering a worker to bypass a safety guard), the damages can be punitive and severe.

Conclusion

Employer Liability Insurance is the financial backstop for when safety management systems fail catastrophically. It exists for the moments when a "standard accident" spirals into a legal battle alleging negligence, incompetence, or malice.

For us in the field, this reinforces a vital truth: our paperwork is not bureaucratic clutter. It is the legal armor that protects the company's future. When you enforce a permit-to-work system or document a near-miss investigation, you are not just preventing an injury; you are building the defense file for a lawsuit you hope never happens.

Comments

Loading...