I once sat in a boardroom with a Project Director who was furious over a $5,000 medical bill for a fractured finger. He thought that was the cost of the accident. I had to slide a different spreadsheet across the table—one that accounted for the three-day site shutdown, the emergency safety stand-down, the investigation hours, and the specialized replacement welder we had to fly in at a premium. The total wasn't $5,000; it was closer to $68,000. That silence in the room is something every HSE manager knows well—it’s the moment management realizes that safety isn’t expensive, but accidents are ruinous.

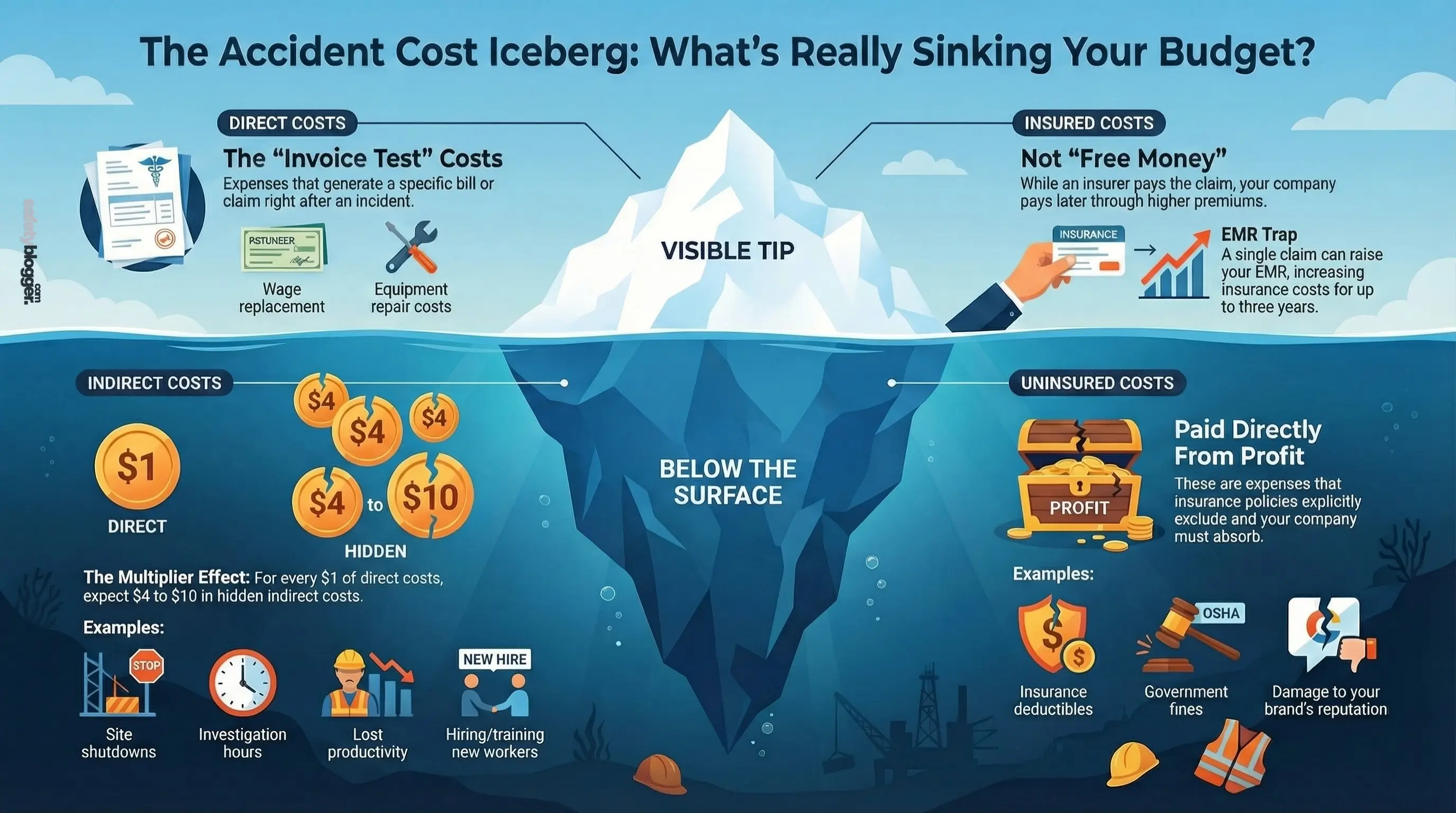

This article breaks down the financial anatomy of a workplace incident, distinguishing between the obvious bills and the hidden "iceberg" costs that bleed projects dry. We will analyze the four critical financial dimensions—Direct, Indirect, Insured, and Uninsured—to prove why preventing an incident is always cheaper than paying for one. Whether you are a site supervisor or a c-suite executive, understanding this balance is critical to protecting both your people and your profit margins.

Direct Costs: The Visible Ledger

When I audit a company’s safety performance, the "Direct Costs" are usually the only numbers the finance team has accurately tracked. This is because Direct Costs pass the "Invoice Test"—if you receive a specific bill, receipt, or claim statement for an expense immediately following an accident, it is a direct cost.

In the industry, we call this the "Visible Ledger" because these expenses appear clearly on your balance sheets and insurance loss runs. They are the "Tip of the Iceberg"—visible, measurable, but rarely the thing that sinks the ship. Here is a granular breakdown of what actually constitutes this section and why it matters.

Medical Expenses (The "Patch-Up" Costs)

This is the most immediate financial hit. In my experience with serious injuries on site, the cost accumulation begins the second the 911 call is made. These costs are typically covered by Workers' Compensation insurance, but they drive up your premiums.

Emergency Response: Ambulance transport (air or ground). In remote mining or offshore projects, a medevac helicopter ride can cost $20,000 to $50,000 instantly.

Acute Care: Emergency room fees, surgical procedures, anesthesia, and hospital room charges.

Ongoing Treatment: This is where costs snowball. It includes follow-up visits, physical therapy, prescription painkillers, and prosthetics.

Case Management: Fees paid to nurse case managers who coordinate the medical care.

Field Note: I once managed a claim for a "simple" back injury from a slip. Between the MRI, surgery, and six months of physical therapy, the medical direct cost alone hit $120,000.

Indemnity and Compensation (Wage Replacement)

When a worker is hurt, they cannot earn a living. The system is designed to bridge that gap. These payments are legally mandated and non-negotiable.

Temporary Total Disability (TTD): Payments made to the worker while they are recovering and completely unable to work (usually 66% of their average weekly wage).

Permanent Partial Disability (PPD): If a worker loses a finger or 20% usage of their shoulder, they receive a lump sum settlement based on a "schedule of benefits."

Death Benefits: In the tragic event of a fatality, payments are made to surviving spouses and children, often for years.

Property and Asset Damage

While human injury is the primary concern, industrial accidents often destroy expensive hardware. These are direct costs because you must pay to repair or replace the asset to resume work.

Equipment Repair: Parts and labor to fix a damaged crane, forklift, or vehicle.

Structure Repair: Fixing damaged racking in a warehouse or scaffolding on a construction site.

Cleanup Costs: The immediate cost of hazardous material cleanup (e.g., spill kits, disposal fees) if the accident involved a chemical release.

The "Deductible" Reality

This is the part most site managers misunderstand. Even if you have insurance, you almost certainly have a deductible (or retention).

If you have a $25,000 deductible per claim:

Scenario: A worker breaks an arm. Medical bills are $18,000.

Result: The insurance company pays $0. Your company writes a check for the full $18,000.

Impact: For smaller incidents, "Direct Costs" are often 100% out-of-pocket, meaning the insurance safety net doesn't even catch you.

Why This Section Matters

The "Visible Ledger" is dangerous because it provides a false sense of security. A manager might look at a $5,000 medical claim and think, "That wasn't so bad." They fail to see that this $5,000 direct cost likely triggered $20,000 in indirect operational losses (downtime, investigation, training).

The takeaway: Direct costs are the entrance fee to an accident scenario. They are the minimum price you will pay, never the maximum.

Indirect Costs: The Hidden Iceberg

If Direct Costs are the "entrance fee" to an accident, Indirect Costs are the monthly subscription that you can't cancel. In my experience managing site safety budgets, this is the section that actually kills profitability.

Indirect costs are deceptive because they are uninsurable. You cannot send a bill to your insurance carrier for "lost productivity" or "low morale." These expenses are absorbed directly by the project, often hidden inside general operating codes like "Overtime," "Administration," or "Miscellaneous."

Here is the breakdown of the hidden chaos that ensues after an incident.

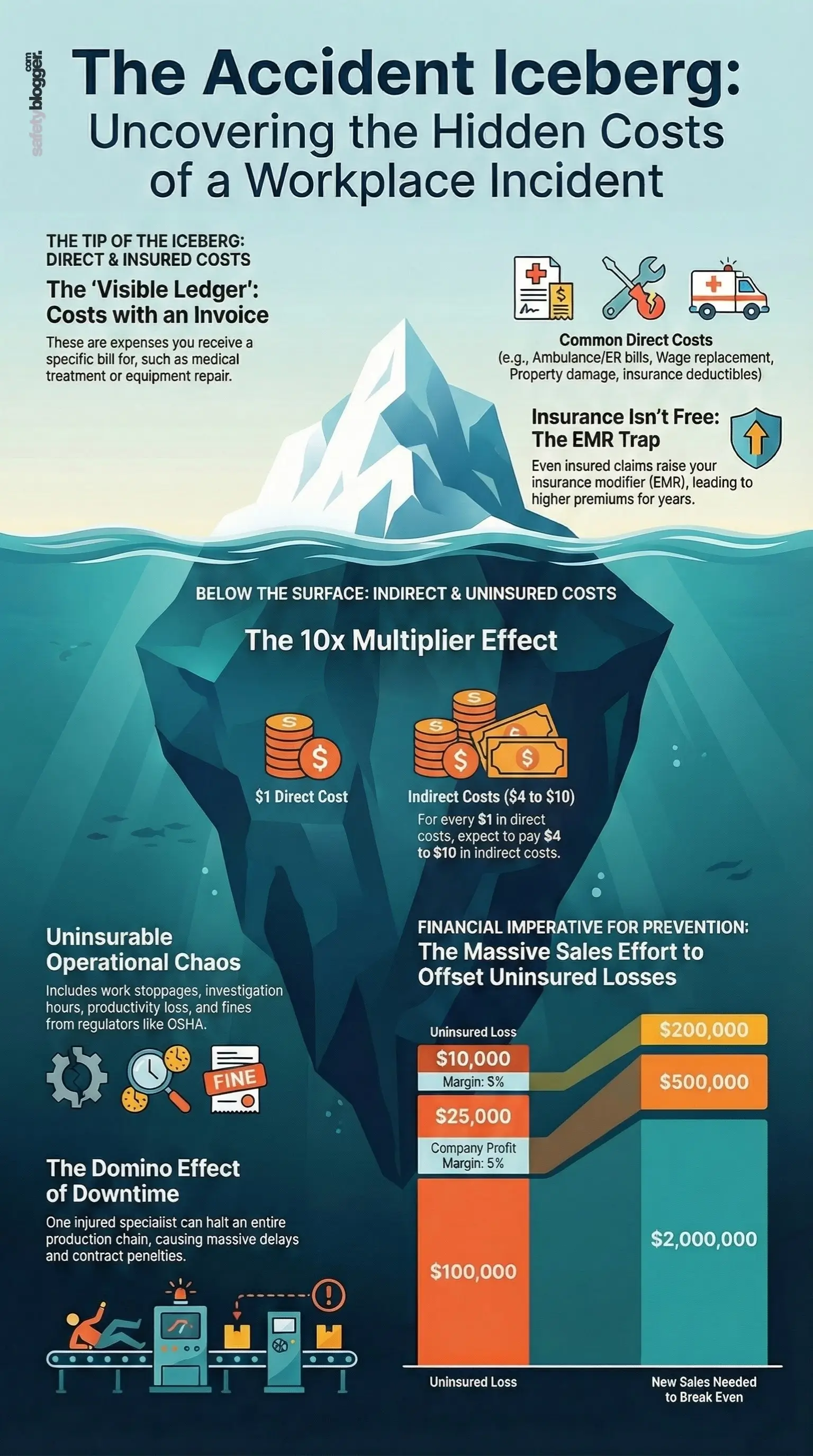

The Multiplier Effect (The "Real" Math)

The industry standard (referenced by OSHA and heavy industry studies) uses a multiplier to estimate these costs.

The Ratio: For every $1 of Direct Cost, you will spend $4 to $10 in Indirect Costs.

The Reality: In complex industries like mining or offshore drilling, where downtime is measured in thousands of dollars per minute, I have seen this ratio hit 20:1.

Operational Disruption (The "Stop Work" Bill)

When an accident happens, the job site doesn't just keep humming along.

Immediate Stoppage: Work stops instantly. The area is taped off. If it's a fatality or major trauma, the police or regulators may shut down the entire site for days.

The "Gaping Hole" in the Crew: If a specialized crane operator gets hurt, the crane stops. If the crane stops, the steel erectors can't work. If the steel erectors can't work, the concrete crew can't pour. One injury creates a domino effect of idleness.

Liquidated Damages (LDs): This is the silent killer. If the accident causes a 3-day delay, and that pushes you past a contract deadline, the client might charge you $10,000 to $50,000 per day in penalties.

Administrative Drag (The Time Sink)

An accident turns productive managers into administrative clerks.

Investigation Hours: A proper Root Cause Analysis (RCA) takes 20–40 hours of work. That involves the Site Manager, HSE Manager (me), and Supervisors sitting in a room instead of building the project.

Paperwork Paralysis: Processing workers' comp forms, meeting with legal counsel, answering regulatory inquiries, and managing return-to-work programs consume hundreds of hours of salaried time.

Regulatory Inspections: An accident is an invitation for OSHA or the local authority to audit your entire site. They will find other things to fine you for, adding costs that wouldn't have existed without the initial accident trigger.

Human Factors and Productivity Loss

This is the hardest to measure but often the most impactful.

The "Replacement" Tax: You have to hire a new worker to fill the gap.

Recruitment costs.

PPE and Safety Induction costs.

Efficiency Gap: A new hire operates at maybe 50% efficiency for the first few weeks. You are paying 100% wages for 50% output.

Morale Plummet: I’ve seen it happen dozens of times. After a bad accident, the crew becomes skittish. They work slower; they second-guess themselves. The "rhythm" of the job site is broken, and overall production can drop by 20–30% in the weeks following the event.

Field Insight: I once audited a project that was "on budget" until a severe hand injury occurred. The medical bill was small ($2k). But the investigation required the Site Superintendent to spend two weeks dealing with regulators. During those two weeks, he took his eye off the schedule, materials weren't ordered on time, and the project ended up losing $150,000 due to the resulting chaos. That is an indirect cost.

Insured Costs: What the Policy Covers

Insured costs are the expenses that are theoretically "paid for" by your insurance carrier. However, viewing these as "free" money is a dangerous fallacy. While the check may come from the insurer, the cost eventually comes back to the company through increased premiums and lost bid opportunities.

These typically cover the direct costs mentioned above:

Workers' Compensation: Covers the medical bills and wage replacement for the injured employee.

General Liability: Covers third-party injuries or property damage if the accident affected the public or a client's asset.

Property Insurance: Covers the replacement of major assets, subject to policy limits.

The Experience Modification Rate (EMR) Trap

Your EMR is the metric insurers use to price your risk. A single severe claim can push your EMR above 1.0.

Premium Spikes: A high EMR increases your insurance premiums for up to three years.

Lost Revenue: Many clients and government tenders disqualify contractors with an EMR above 1.0. The "Insured Cost" of an accident might result in millions of dollars in lost future contracts.

Uninsured Costs: What You Pay Out of Pocket

Uninsured costs are the financial leaks that insurance policies explicitly exclude. These come directly from the project's profit margin. In my experience, this is the category that bankrupts small-to-medium contractors who are not prepared for the cash flow hit.

The Deductible

Before insurance pays a dime, you pay the deductible. On commercial heavy industry policies, deductibles can range from $10,000 to $50,000 per incident. This is immediate cash out the door.

Regulatory Penalties and Legal Fees

Fines: Penalties from OSHA, the EPA, or local authorities are never covered by insurance. These are punitive measures intended to hurt the company financially.

Legal Defense: While some liability policies cover defense costs, many do not cover the full extent of legal fees, especially if criminal negligence is alleged.

Consultant Fees: If a regulator forces you to conduct a third-party safety audit or process redesign, you pay that bill.

Reputation and Brand Damage

Client Confidence: Being removed from a client's "Approved Vendor List" due to poor safety statistics (TRIR/LTIR).

Public Perception: In the age of social media, a video of an unsafe act or accident can go viral, causing irreparable damage to the company's brand equity.

Conclusion

The true price of an accident is rarely found on the medical invoice. It is buried in the unrecoverable hours of lost time, the spike in insurance premiums, and the silent drain on operational efficiency. When we view safety only as a compliance box to check, we expose the company to uninsured financial risks that can erase the profit margin of an entire fiscal year.

My advice to leadership is to look beyond the direct costs. Calculate the "Sales Required to Cover Losses"—if you have a 5% profit margin, a single $10,000 uninsured loss requires $200,000 in new revenue just to break even. Investing in safety is not just an ethical imperative; it is the smartest financial defense your company can mount.

Comments

Loading...